Market Veers Lower in Light Trading as Oil Dips Again

What a fun market this is!

After existence totally bored making money on bullish bets in 2017, 2018 has been a non-stop thrill-ride with money to be made in both directions. Yesterday, nosotros got notwithstanding another gamble to short the Russell (/TF) at our 1,550 line and we got another 20-signal drop to ane,530, which was skillful for gains of $1,000 per contract and our call to go long on Coffee(/KCH8) at $119 from yesterday's Morning Report is already percolating at $120.50 and that's good for gains of $562.50 per contract already and gilded (/YG, besides from yesterday'southward Report) has jumped from $ane,327.fifty to $1,330.l only that's only good for gains of $96.threescore per contract, equally it'due south a cheap contract.

These are just the quick trade ideas nosotros give away for gratuitous folks! If yous want more trade ideas, I'll be on Benzinga TV's Pre-Market Prep Show at eight:35 this morning – Melody in here .

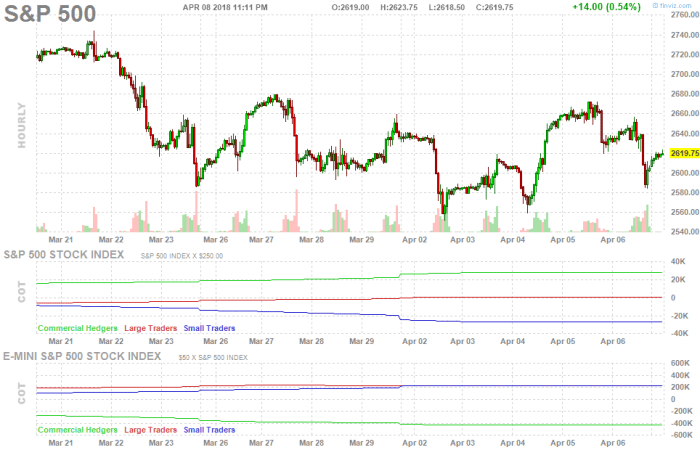

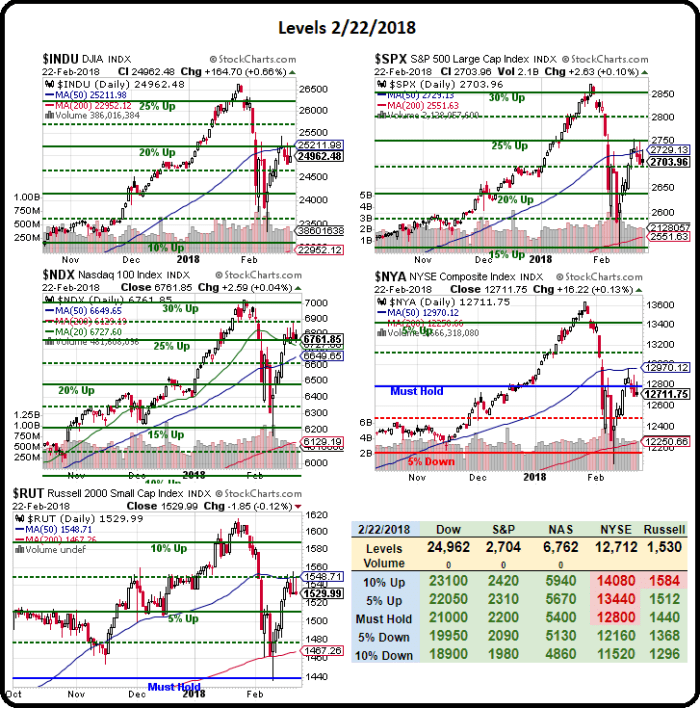

Meanwhile, nosotros're not at all fooled by the pre-marketplace bounce in the indexes as nosotros're still not immigration those strong bounciness lines and it's the same lines we've been using since the crash, which I last updated in Wed's Report:

Since then, have nosotros fabricated any improvements?

No, plainly not, so don't lose perspective and, most importantly, don't get excited when the marketplace, like a ball, bounces less than half of what it roughshod – particularly when it's 2 weeks later and you lot're still non moving higher. Information technology'due south more than probable, at this point, that we're consolidating for a movement down than a motility upwards but +180 on the Dow at the open is the pre-market push that reels the Retail Suckers in while the Institutional Investors dump their holdings into the weekend.

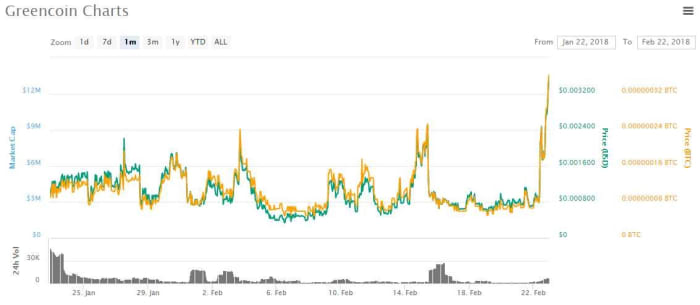

Last time I was on Benzinga, we talked about GreenCoin, which was 0.001 at the time and I don't know if it'due south just because I'yard scheduled to be on again today only GreenCoin has shot up to 0.004, which is upwards 300% in a month so you lot're welcome for that one!

Keep in mind all cryptocurrencies are silly then, if you take more than a double and don't take one-half off the tabular array (leaving you lot with one-half for free) – you are but being a fool, who is likely to shortly be parted with his coin!

Less foolish is our relentless shorting of the Futures at our Strong Bounce Lines which are also the 50-twenty-four hours moving averages this calendar week with the S&P right at two,728 forth with Dow 25,212, Nasdaq six,650, NYSE 12,970 and Russell 1,550 and it'due south great when nosotros meet the moving averages move right into our Bounciness Lines as information technology means our five% Rule™ is working, which means the market is being traded past robots (as that's what the 5% Rule assumes) and, therefore, anticipated.

Predictable works for me considering Mon, at the NY Trader's Expo, I volition be participating in a Alive Trading Claiming at the open so encounter who tin can make the nearly money in lx minutes and so we'll be putting all this BS to a examination live, in forepart of a pretty big audition. I'll also be giving a iv-hour Principal Class to open the bear witness on Dominicus from 9am to 1pm – and so come on down if yous want to acquire all of our trading tricks! We got the whole thing underwritten then information technology's now complimentary!

Meanwhile, we're shorting the indexes this morning time at 25,150, 2,725, vi,825 and 1,540 with tight stops if any of them go back above. Every bit you tin can see, we're already upwards about $2,000 on our Coffee Merchandise for the twenty-four hour period and then tight stops at the $122 line at present simply, long-term, we love that merchandise and, if you lot are futures-challenged, in that location's e'er the Java ETF (JO), which is at $14.80 and the fashion I'd play it is:

- Sell v 2020 $14 puts for $1.30 ($650)

- Buy 10 2020 $fifteen calls for $ii.50 ($2,500)

- Sell 10 2020 $20 calls for $one.25 ($ane,250)

That's net $600 on the $five,000 spread, so the upside potential is $4,400 (733%) at $20. Nosotros need Coffee (/KC) to exist upwardly 33% over two years, which would exist $162, which is roughly the 2016 highs merely well beneath $200+ in 2014 and $300 in 2011. On the whole, nosotros're playing for Global Warming disrupting the growing patterns and causing shortages – something Bloomberg just did a special report on.

$122 to $162 is up $forty and Coffee Futures contracts pay $375 per $one and then $15,000 per contract but we will be in and out hundreds of times between now and than – usually buying the dips, getting out on pops (similar this morning) and then starting the bike again on the next dip. We don't heed making the aforementioned play over and over once again – not when we tin can pick up $2,000 in a morning, right?

Have a great weekend,

- Phil

Source: https://www.thestreet.com/phildavis/stocks-options/friday-market-flip-flop-wake-up-and-smell-the-coffee-futures

0 Response to "Market Veers Lower in Light Trading as Oil Dips Again"

Enviar um comentário